Teachers are among the most important professionals in our communities, shaping the future and providing invaluable services to students. However, when it comes to buying a home, teachers can often face the same challenges as other first-time buyers: affordability, credit concerns, and navigating the complex home buying process. Luckily, Texas offers several home buying programs specifically designed to help teachers achieve the dream of homeownership.

In this article, we will explore the various teacher home buying programs in Texas, what they offer, and how they can make purchasing a home more accessible for educators.

Why Teacher Home Buying Programs Matter

Teachers often face unique financial circumstances that can make buying a home more difficult. Long hours, relatively modest salaries, and limited resources for saving for a down payment can create obstacles. Home buying programs aimed at educators can help ease some of these challenges by offering:

- Down payment assistance: Help with upfront costs that can be a barrier to homeownership.

- Lower interest rates: More affordable financing options.

- Specialized loans: Tailored mortgage products designed for teachers.

- Exclusive incentives: Programs that provide additional benefits such as rebates, tax incentives, and grants.

Fortunately, Texas recognizes the value of teachers in the community and has developed various programs to assist them in buying homes.

1. Texas Teacher Home Loan Program (Seth 80 Program)

The Seth 80 Program is a popular home buying program available to Texas teachers, offering significant assistance to first-time homebuyers. The program is administered by the Southeast Texas Housing Finance Corporation (Seth) and is designed to make homeownership more affordable for teachers and other professionals.

Key Features:

- Down Payment Assistance: Teachers can receive up to 4% of the loan amount for down payment and closing costs.

- Competitive Interest Rates: The program offers lower interest rates compared to traditional loans, which can make monthly payments more affordable.

- Eligibility: Teachers must be first-time homebuyers (not having owned a home in the last three years) or meet other specific requirements. They must also have a credit score of at least 620.

- Loan Types: The program offers fixed-rate loans, making it easier for teachers to budget and plan for the long term.

How It Helps:

By offering both down payment assistance and lower interest rates, the Seth 80 Program can significantly reduce the financial burden of purchasing a home, allowing Texas teachers to purchase homes more easily and at more affordable rates.

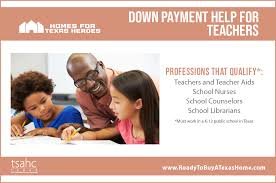

2. Texas State Affordable Housing Corporation (TSAHC) Programs

The Texas State Affordable Housing Corporation (TSAHC) is another resource for teachers looking to buy a home in Texas. TSAHC offers a variety of programs that can help educators become homeowners, including down payment assistance and competitive loan rates.

Key Features:

- Down Payment Assistance: TSAHC provides up to 5% of the loan amount in down payment assistance for eligible first-time homebuyers, which can be used to cover the down payment, closing costs, and other fees.

- Mortgage Credit Certificate (MCC): Teachers can apply for a mortgage credit certificate, which allows them to receive a federal tax credit of up to $2,000 per year for the life of the loan, helping them save money on taxes.

- Flexible Eligibility Requirements: Teachers who meet income limits and credit score requirements can qualify, and the program is available statewide, including both urban and rural areas of Texas.

How It Helps:

The combination of down payment assistance and tax credits makes homeownership more affordable for teachers. The MCC offers long-term savings, and TSAHC’s programs are open to teachers who may not have significant savings for a down payment.

3. Teacher Next Door (TND) Program

The Teacher Next Door (TND) program is a nationwide initiative aimed at helping teachers purchase homes. While the program is available throughout the U.S., it has specific offerings for Texas teachers looking to buy a home in the state.

Key Features:

- Home Buying Assistance: The Teacher Next Door program offers substantial discounts on homes through the HUD (U.S. Department of Housing and Urban Development), providing teachers access to government-owned homes at a significant discount.

- Down Payment Grants: TND can offer grants for teachers to assist with down payments and closing costs, making it easier for teachers to afford a home.

- Eligibility: Teachers must work in a public or private school system and meet other requirements, including income restrictions.

How It Helps:

This program directly addresses the financial barriers to homeownership by offering grants and discounts. Teachers can find affordable properties through HUD, and the down payment assistance makes it easier for them to qualify for a mortgage.

4. Local Teacher Housing Assistance Programs

In addition to statewide programs, several Texas cities and local organizations offer homebuyer assistance programs specifically for teachers. These programs may include down payment assistance, homebuyer education courses, or local tax incentives. Some cities in Texas with specific teacher home buying programs include:

- Houston: The Houston Housing Authority offers a variety of homebuyer programs for teachers, including the Homebuyer Assistance Program, which provides down payment and closing cost assistance.

- Dallas: The Dallas Housing Finance Corporation offers affordable housing programs for teachers, including down payment assistance and tax credits.

- San Antonio: San Antonio offers the Homeownership Incentive Program, which provides financial assistance to eligible teachers in the area.

These programs may vary in terms of eligibility and funding, so it’s important to check with local housing authorities to see if your area offers assistance.

5. Federal Housing Administration (FHA) Loans

While not specific to teachers, FHA loans are a popular option for educators in Texas who may not qualify for conventional mortgages. The FHA insures loans made by approved lenders, allowing teachers to purchase a home with a lower down payment (as low as 3.5%) and more flexible credit score requirements.

Key Features:

- Lower Down Payment: Teachers can buy a home with just 3.5% down, which is significantly less than the typical 10-20% down payment required for conventional loans.

- Competitive Interest Rates: FHA loans often come with lower interest rates compared to other conventional loan options.

- Eligibility: While FHA loans are not exclusive to teachers, they can be a great option for first-time homebuyers, including teachers with less-than-perfect credit.

How It Helps:

The lower down payment and more lenient credit requirements make FHA loans an attractive option for teachers who may have trouble saving a large down payment or whose credit history doesn’t meet conventional loan standards.

How to Apply for Teacher Home Buying Programs in Texas

- Research Eligibility Requirements: Each program has specific eligibility criteria, such as income limits, credit score requirements, and whether you’re a first-time homebuyer. Be sure to review the requirements before applying.

- Get Pre-Approved for a Mortgage: Before applying for any home buying program, it’s essential to get pre-approved for a mortgage. This will help you understand your budget and ensure that you qualify for the program.

- Find a Participating Lender: Many of these programs work with specific lenders. You’ll need to find a lender that participates in the program you’re interested in. For example, TSAHC works with a network of participating lenders.

- Submit an Application: Once you’ve identified the right program and lender, you can submit your application for down payment assistance or mortgage benefits.

Conclusion

Texas offers a wide range of home buying programs specifically designed for teachers. Whether you’re a first-time homebuyer or looking for assistance with down payments, these programs provide valuable financial support to help educators achieve homeownership. Programs like the Texas Teacher Home Loan Program, TSAHC, Teacher Next Door, and local initiatives can provide the resources you need to make the home buying process easier and more affordable.