Mortgage refinance rates are a critical factor for homeowners considering refinancing their mortgage to achieve financial goals such as reducing monthly payments, shortening loan terms, or accessing equity. This guide delves into the intricacies of mortgage refinance rates, exploring how they work, factors that influence them, and tips to secure the best rates.

What Are Mortgage Refinance Rates?

Mortgage refinance rates are the interest rates lenders offer to homeowners who wish to replace their existing mortgage with a new one. These rates can be fixed or variable, depending on the type of loan chosen. The goal of refinancing is typically to lower the interest rate, which can save money over the life of the loan or to adjust the terms of the mortgage to better align with the homeowner’s financial situation.

Factors Influencing Mortgage Refinance Rates

Several factors influence the refinance rates offered by lenders:

1. Credit Score

A higher credit score demonstrates financial reliability, often leading to lower refinance rates. Lenders typically offer the most competitive rates to borrowers with scores above 740.

2. Loan-to-Value Ratio (LTV)

LTV measures the loan amount relative to the home’s appraised value. A lower LTV ratio indicates less risk for the lender, potentially resulting in better rates.

3. Debt-to-Income Ratio (DTI)

DTI is the percentage of monthly income used to pay debts. Lenders prefer borrowers with lower DTIs, as it suggests better financial stability.

4. Market Conditions

Economic factors, such as inflation, Federal Reserve policies, and the overall state of the economy, significantly impact refinance rates.

5. Loan Term

Shorter-term loans, like 15-year mortgages, generally have lower interest rates compared to 30-year loans, though monthly payments may be higher.

6. Type of Refinance

The purpose of the refinance, whether it’s a rate-and-term refinance, cash-out refinance, or streamline refinance, can also affect rates.

Benefits of Refinancing Your Mortgage

Refinancing can offer several advantages:

1. Lower Interest Rates

Securing a lower interest rate can reduce monthly payments and save thousands of dollars over the loan’s life.

2. Shorten Loan Term

Refinancing to a shorter-term mortgage, such as a 15-year loan, can help pay off your home faster and reduce the total interest paid.

3. Switch Loan Types

Homeowners can switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for stability or vice versa for potential savings.

4. Access Home Equity

Cash-out refinancing allows homeowners to access the equity in their homes for major expenses, such as home improvements, education, or debt consolidation.

Steps to Secure the Best Mortgage Refinance Rates

1. Check Your Credit Score

Review your credit report and address any inaccuracies. Paying down existing debts can improve your credit score.

2. Shop Around

Compare offers from multiple lenders, including banks, credit unions, and online mortgage lenders, to find the most competitive rates.

3. Consider Closing Costs

Refinancing involves closing costs, typically 2% to 5% of the loan amount. Evaluate whether the savings from a lower rate outweigh these costs.

4. Lock in Your Rate

Once you’ve chosen a lender, consider locking in the interest rate to protect against rate fluctuations during the closing process.

5. Evaluate Timing

Refinancing makes sense when rates are significantly lower than your current mortgage rate or if your financial situation has improved.

Common Types of Mortgage Refinancing

1. Rate-and-Term Refinance

This type of refinance focuses on reducing the interest rate or adjusting the loan term without accessing home equity.

2. Cash-Out Refinance

Homeowners can borrow more than the remaining mortgage balance and receive the difference in cash. This option is ideal for funding large expenses.

3. Streamline Refinance

Streamline refinancing is a simplified process available for government-backed loans, such as FHA or VA loans, requiring minimal documentation.

Current Trends in Mortgage Refinance Rates

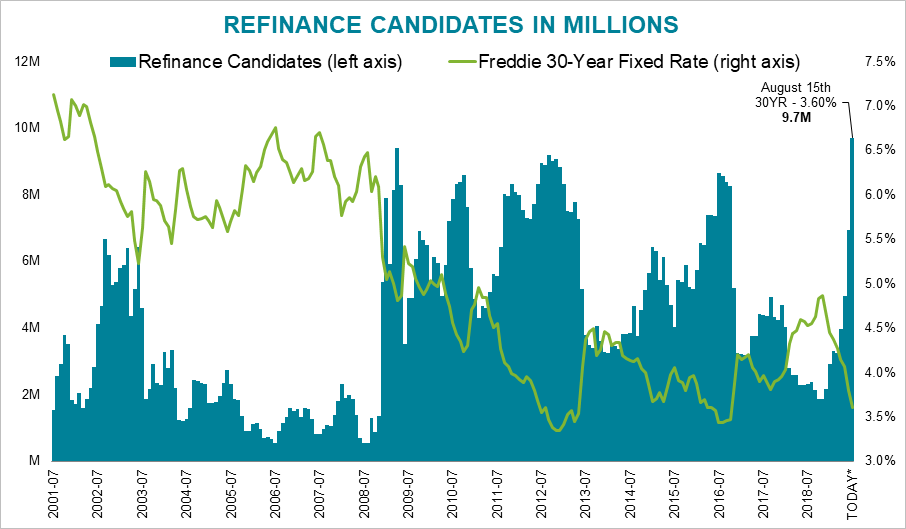

Refinance rates fluctuate due to economic conditions and lender competition. In recent years, rates have reached historic lows, prompting many homeowners to refinance. However, rates can rise quickly during periods of inflation or economic growth.

Is Refinancing Right for You?

Refinancing isn’t always the best option for everyone. Consider the following:

- Breakeven Point: Calculate how long it will take for monthly savings to cover the closing costs.

- Future Plans: If you plan to sell your home soon, refinancing might not be cost-effective.

- Loan Term Reset: Refinancing resets the clock on your mortgage, potentially increasing long-term interest payments.

Conclusion

Understanding mortgage refinance rates and the factors influencing them is essential for making informed financial decisions. By assessing your goals, comparing lender offers, and considering market conditions, you can determine whether refinancing is a smart move for your situation. With the right approach, refinancing can lead to significant savings and improved financial stability.